If you prepare your extension using software that supports e-file, y ou must e-file your extension. It's free, and you'll receive instant email confirmation that we received your extension request. You can request an extension directly on our website.

There are special filing deadlines in certain instances.Īn extension request filed after the filing deadline for your return will be invalid. *Calendar year partnership filers can no longer request a 2022 extension since the filing deadline has passed. Filing deadlines FilerĢ022 Filing deadline for calendar-year filers You must file your extension request on or before the filing deadline of your return. Form IT-205, Fiduciary Income Tax Return.Form IT-203-GR, Group Return for Nonresident Partners (Note: Group agents must enter the special identification number assigned to the partnership-that is, group ID 80081XXXX -in the Full Social Security number field.).Form IT-203, Nonresident and Part-Year Resident Income Tax Return.Form IT-201, Resident Income Tax Return.If you can't file on time, you can request an automatic extension of time to file the following forms: If you need help filing your extension, contact us. Remember to file your extension request by the tax deadline to avoid penalties or interest on unpaid tax liability.If you need more time to file, you can request an income tax extension ( below) or corporation tax extension online. By following the steps outlined above and avoiding common mistakes, you can ensure that your form is completed correctly and on time. In conclusion, the IRS 4868 form can be a helpful tool for individuals who need more time to file their tax returns. Additionally, if you provide false information on the form, you may be subject to fines, penalties, and potentially criminal charges. If you fail to file the IRS 4868 form, you may be subject to penalties and interest on any unpaid tax liability. Mailing the application to the wrong address or not allowing enough time for delivery.Providing incorrect personal information such as name, address, or social security number.Failing to include the estimated tax payment.Forgetting to sign and date the application.

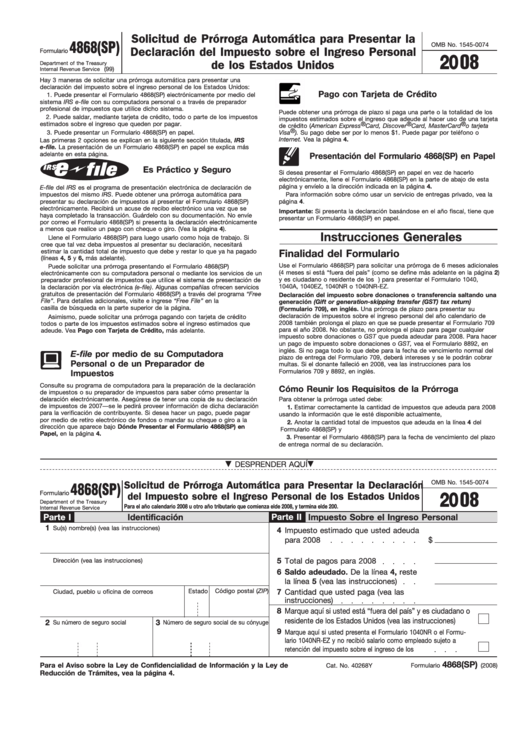

This can be done through electronic payment, credit or debit card, or by mailing a check to the IRS. Additionally, you will need to make a payment of any estimated tax liability you owe. You can use the IRS 1040 form to estimate your tax liability. You must provide your name, address, social security number, and an estimate of your total tax liability for the year. This form is important because it can give you an additional six months to file your tax return, which can be helpful if you need more time to gather your tax information or if you need to file an amended return.

The IRS 4868 form is an application for an automatic extension of time to file individual income tax returns.

0 kommentar(er)

0 kommentar(er)